Fine Beautiful Tips About How To Find Out Previous Years Agi

To retrieve your original agi from your previous year's tax return you may do one of the following:

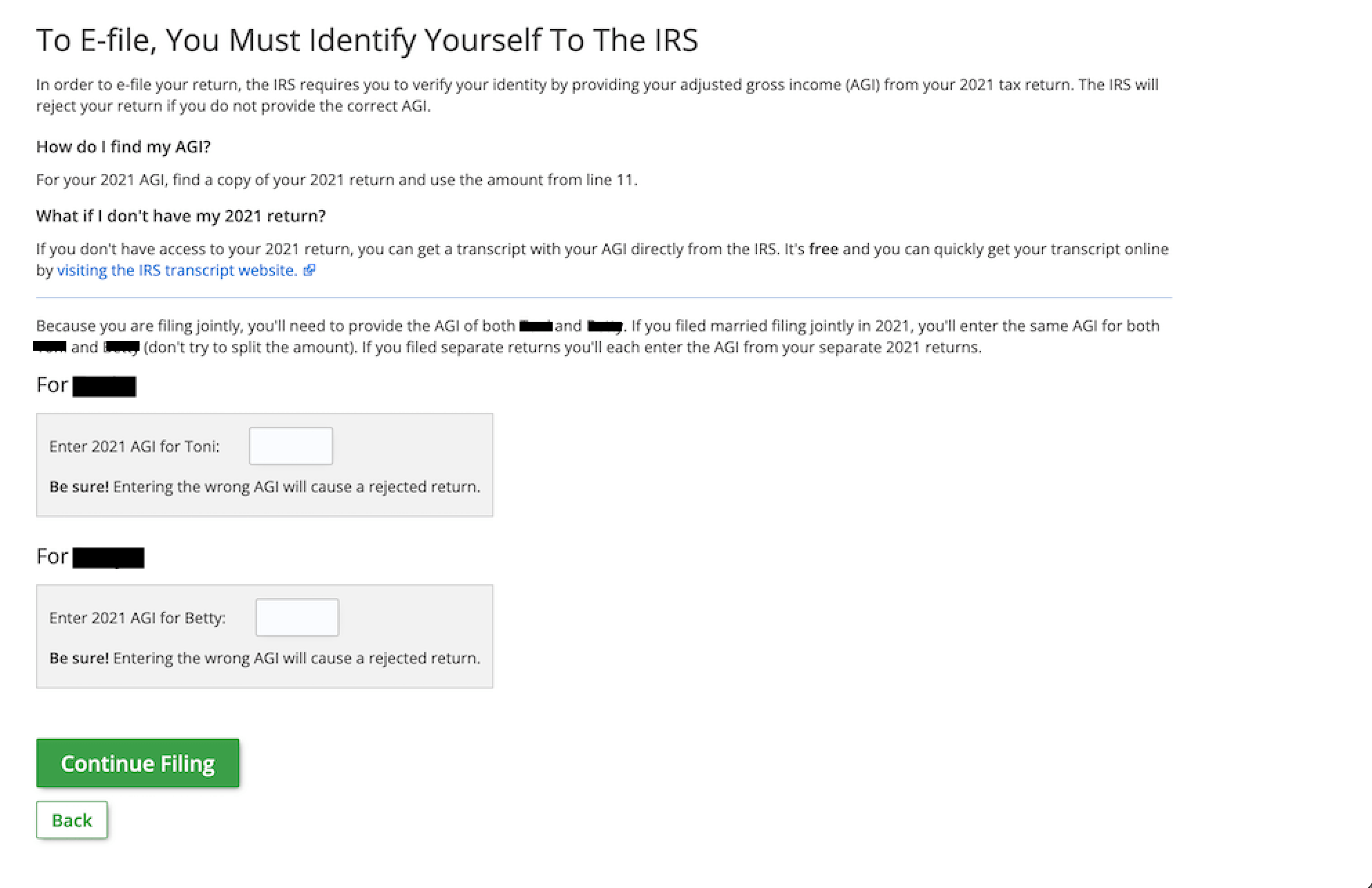

How to find out previous years agi. How to locate your previous year agi if you don’t have access to. As part of the signature process when filing a return electronically, the irs requires an identifying piece of information. To retrieve your original agi from your 2019 tax return (or from the original return if you filed an amended return), you may do one of the following:

To retrieve your original agi from your previous year's tax return (or from the original return if you filed an amended return) you may do one of the following: Your tax return if you’re the type of person who has a knack for keeping track of important paperwork, then you probably know where to find your tax return from last year. If you don't have a prior year return to find your previous year’s agi, you have a few options.

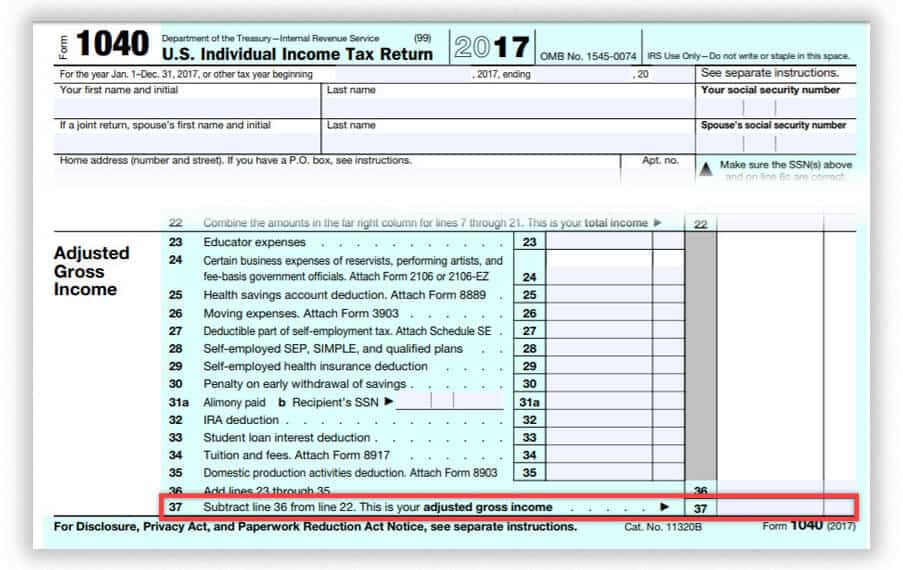

Here is where to find your prior year agi based on the income tax return you filed: Go to www.irs.gov and request a. Your 2018 tax return shows your 2018 adjusted gross income (agi) if you filed a joint return then the agi is the same for each of you.

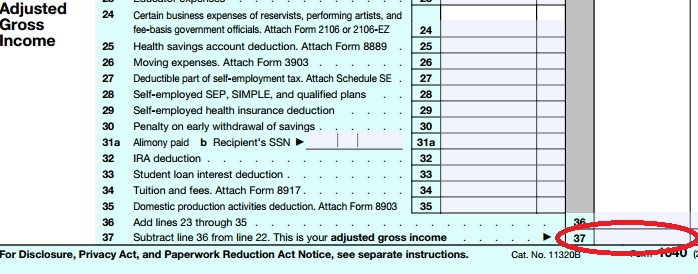

Locate or retrieve your previous year agi where is my adjusted gross income (agi) located on my prior year return? There are three ways for taxpayers to order a transcript: Locating last year’s tax return.

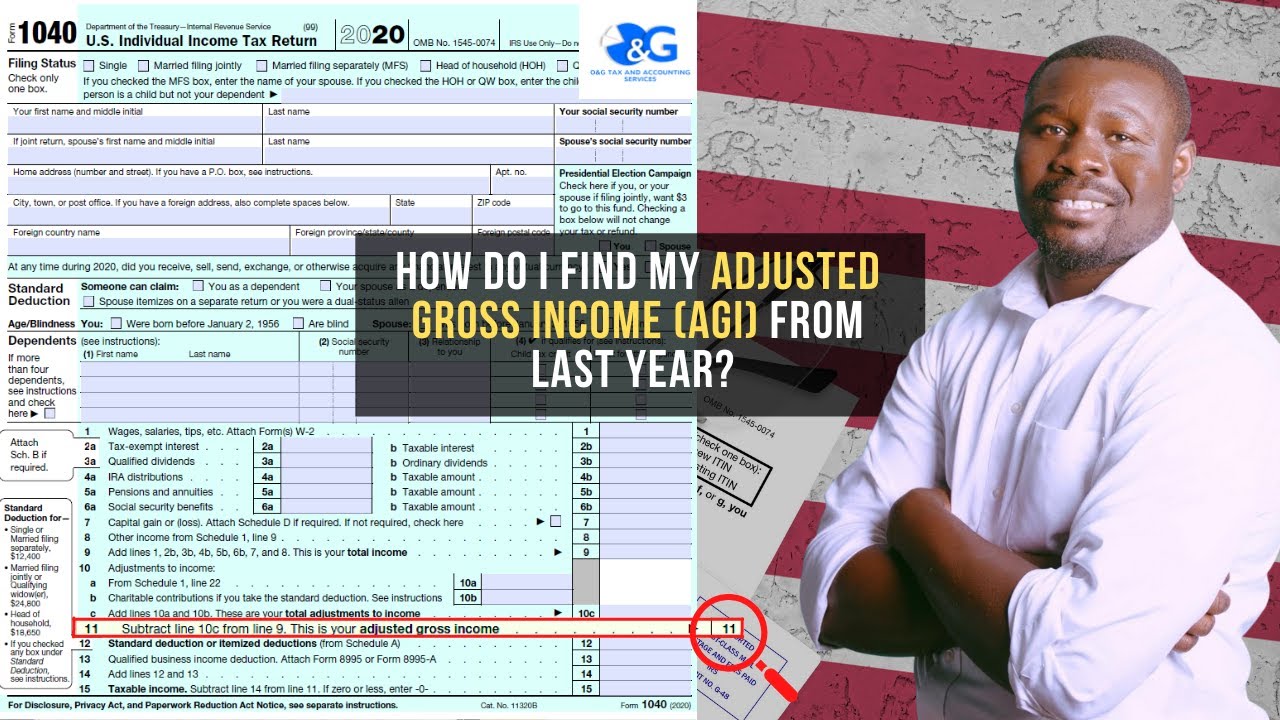

No matter the form, you’ll be able to find your adjusted gross income. Here’s how to find your agi: The 2020 agi is on the 2020 federal tax return form 1040 line 11 to access your prior year online tax returns sign onto the turbotax website with the user id you used to create.

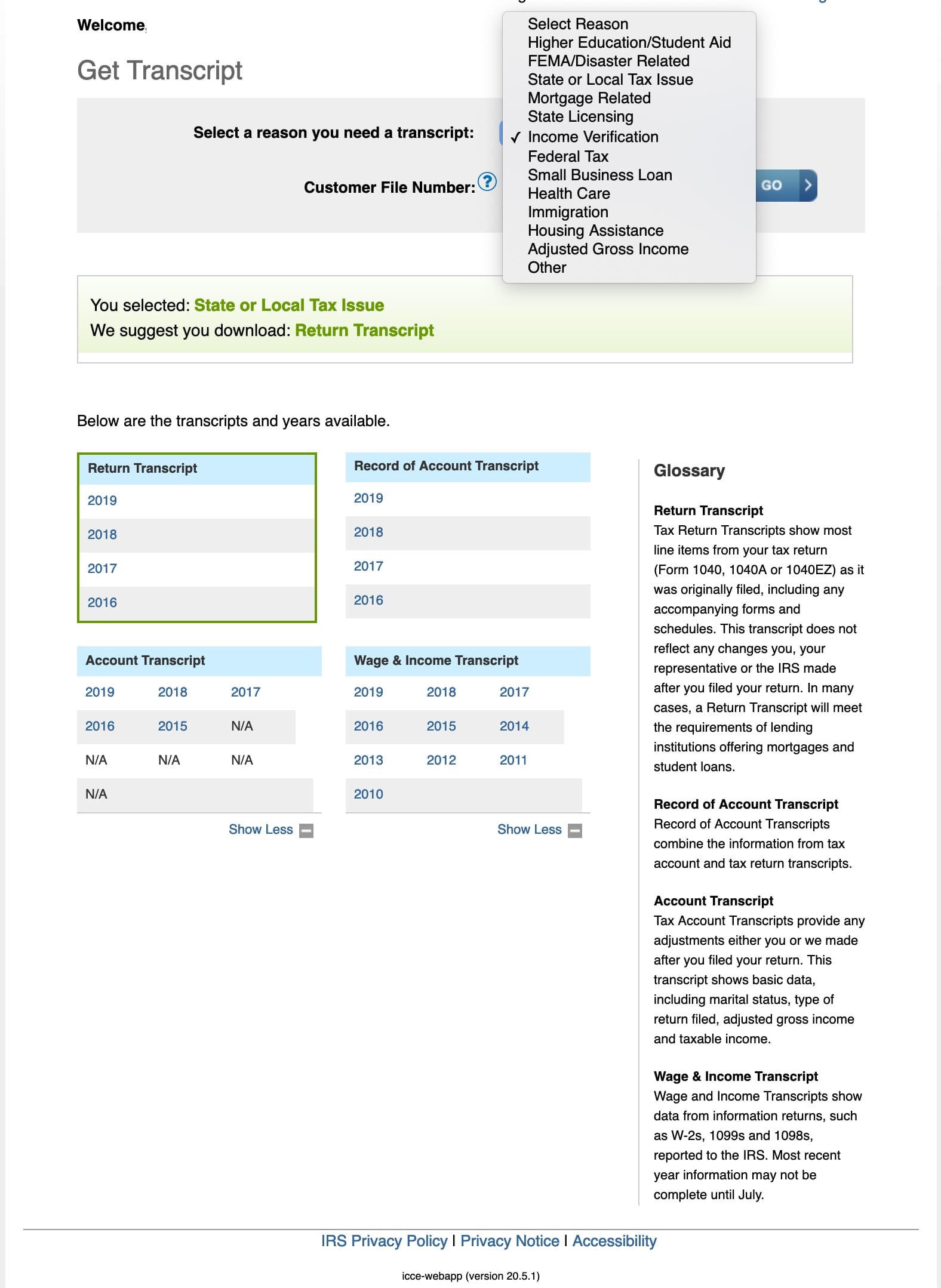

How do you get your agi from last year? There are other ways you can get your prior year’s agi. Get your transcript online order an online transcript of your return at the irs welcome.

/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)